Serengeti Energy [NDF C99]

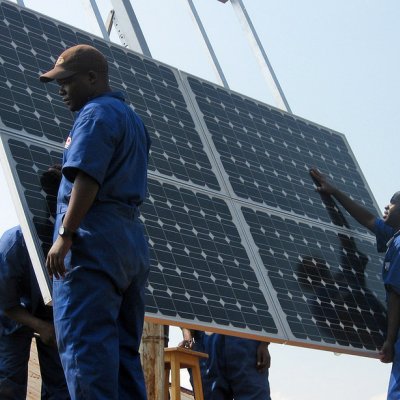

Photo: Walt Ratterman

Photo: Walt Ratterman

Serengeti Energy's mission is to increase the renewable energy supply in Sub-Saharan Africa with initial focus on East Africa at a reasonable price and in a responsible way, while generating attractive, long-term, stable cash flow across a diversified portfolio of renewable energy plants.

REGION

Africa

PROJECT REFERENCE

NDF C99

DURATION

2017 to 2025

(After 2025 focus on managing the assets)

NDF FINANCING

Equity: EUR 7.0 million

Grant: EUR 0.5 million

FINANCING TYPE

Equity, Grant

IMPLEMENTING AGENCY

Serengeti Energy

NDF CONTACT

Michelle Voon

(michelle.voon@ndf.int)

OBJECTIVE

The overall objective of supporting Serengeti Energy is to help them increase the renewable energy supply in Sub-Saharan Africa (SSA) with an initial focus on East Africa at a reasonable price and in a responsible way, while generating attractive, long-term, stable cash flows across a diversified portfolio of renewable energy plants.

Serengeti Energy has identified a gap in the market. On the one hand, there is an existing and constantly growing demand for the supply of electricity and there is investor interest in the SSA area. On the other hand, the missing link is the availability of small to medium-sized projects that can be implemented and are investable. This means that if you want to invest in small- to medium-scale power plant projects, they need to be built first. Larger companies focus on larger projects creating a niche for smaller projects to be developed that Serengeti Energy is ready to capitalise on.

By supporting Serengeti Energy, NDF will help Serengeti Energy materialise the projects in the pipeline and act as a catalyser for further investments by both other Development Finance Institutions (DFI) and private investors. Serengeti Energy's target for 2017 is to raise USD 50 million and by that increase the total capital base to USD 75 million. The long term goal is to have a capital base of USD 250 million which rAREH aims at reaching in 2020.

The following outcomes are expected:

-

Access to affordable clean energy

-

610,000 MWh/year of renewable electricity produced and fed into the local/national grid

-

Taxes paid by the local project companies benefitting the community

-

Jobs created during both the construction phase and also during operation of the energy assets

-

Climate stability by reducing the carbon intensity of energy. 350,000 tons of CO2 avoided P/A.

FINANCING

The target for this second capital raise is USD 50 million. NDF is providing EUR 7.0 million (approx. USD 7.8 million) in shareholder equity and EUR 0.5 million (approx. USD 0.6 million) in grant for Technical Assistance (TA) while Serengeti Energy provides USD 0.5 million and other investors about USD 41.5 million in shareholder capital.

OTHER INFORMATION

On 26 November 2019, the Board of Directors approved additional financing of EUR 10 million as shareholder equity to bring the projects under development to financial close and to expand further the renewable energy supply in Sub-Saharan Africa.

NDF CONTACT

Michelle Voon, Program Manager (michelle.voon@ndf.int)