Governing bodies and capital

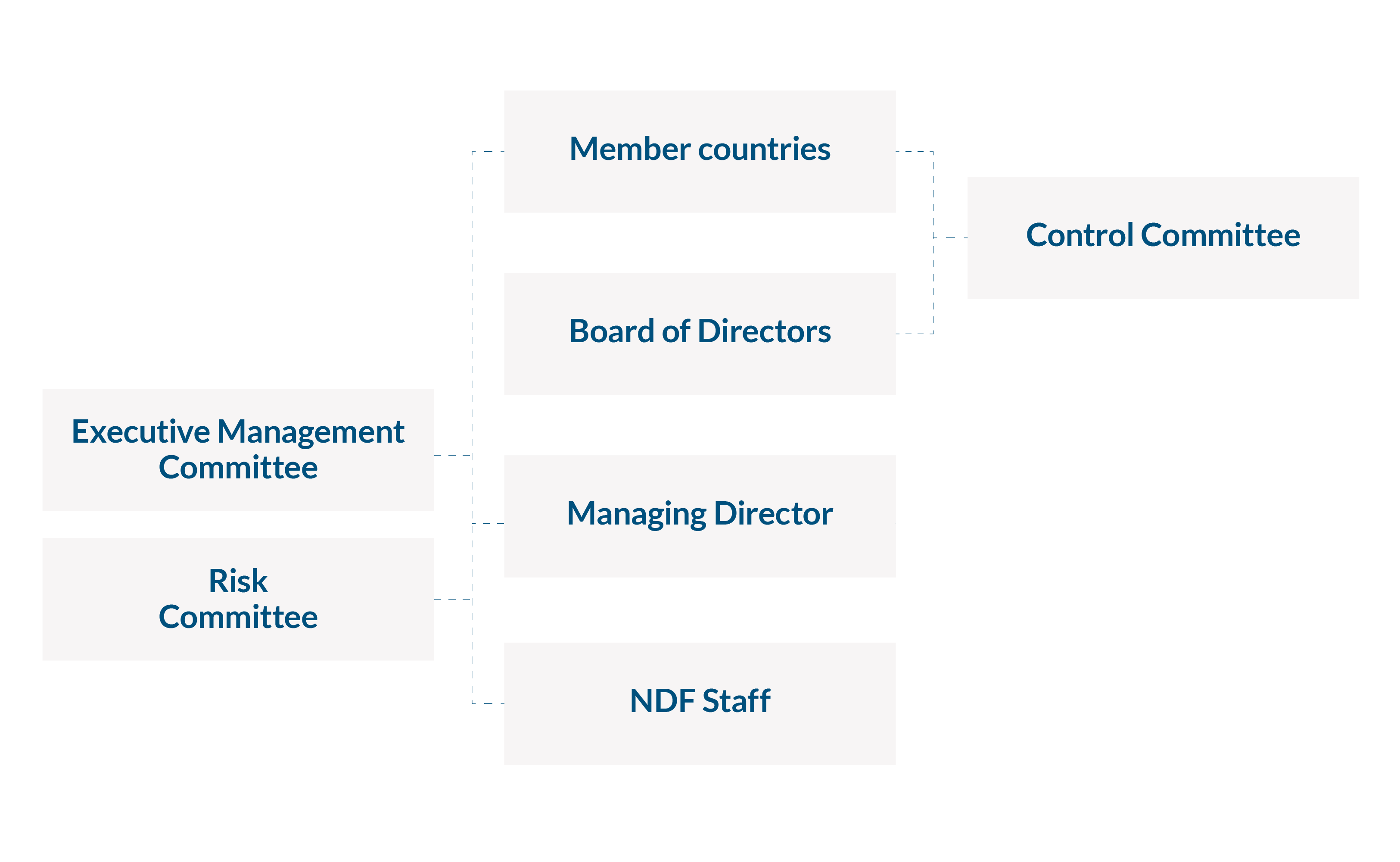

The structure of NDF’s governing bodies reflects NDF’s status as an international financial institution owned by the five Nordic countries.

Board of Directors

With a few exceptions, the Board has all the statutory powers to make decisions in NDF. Consequently, the Board of Directors makes the strategic and policy decisions concerning the operations and other activities of NDF. The Board of Directors approves the financing of projects proposed by NDF’s Managing Director. The Board of Directors also approves the annual budget and is responsible for NDF’s financial statements. The Board of Directors may delegate its powers to the Managing Director to the extent considered appropriate.

Each member country appoints one member and one alternate to NDF’sBoard of Directors for a term of up to five years. The Board of Directors elects a Chair and Deputy Chair for a term of one year at a time. The positions of the Chairand the Deputy Chairrotate among the member countries. The Nordic Investment Bank (NIB) has an appointed Observer without the right to vote in the Board of Directors. The GeneralCounsel of NDF serves as Secretary to the Board of Directors.

Members of the Board of Directors

Denmark

Morten Houmann Blomqvist, Chief Consultant, Ministry of Foreign Affairs (Chair of the Board)

Finland

Anna Merrifield, Director, Ministry for Foreign Affairs (Deputy Chair of the Board)

Alternate: Johanna Pietikäinen, Senior Specialist, Climate Finance, Ministry for Foreign Affairs

Iceland

María Erla Marelsdóttir, Ambassador, Ministry for Foreign Affairs

Alternate: Geir Oddsson, Permanent Representative, Ministry for Foreign Affairs

Norway

Hans Olav Ibrekk, Special Envoy Climate and Security, Ministry of Foreign Affairs

Alternate: Jenny Stenberg Sørvold, Senior Adviser, Ministry of Foreign Affairs

Sweden

Henrik Bergquist, Deputy Director, Ministry for Foreign Affairs

Alternate: Leif Holmberg, Deputy Director, Ministry for Foreign Affairs

Observer

Johan Ljungberg, Senior Director, Nordic Investment Bank

Secretary

Christina Stenvall, General Counsel, NDF

Control Committee

The Control Committee is NDF’s supervisory body. It ensures that NDF’s operations are conducted in accordance with the Statutes of NDF. The Control Committee is responsible for the audit of NDF and submits its annual audit report to the Nordic Council of Ministers.

The Nordic Council appoints five Nordic parliamentarians to the Committee i.e one per member country. The Chair of the Committee is appointed by the Nordic Council of Ministers. The Control Committee appoints two professional external auditors for the purposes of assisting the Committee in carrying out its work and responsibilities. One of the appointed professional auditors is from NDF’s host country (Finland) and one from another member country.

Members of the Control Committee

Chairman

Aud Lise Norheim, Ambassador (retired)

Denmark

Sjúrður Skaale, Member of Parliament

Finland

Noora Fagerström, Member of Parliament

Iceland

Vilhjálmur Árnason, Member of Parliament

Norway

Truls Vasvik, Member of Parliament

Sweden

Lars Püss, Member of Parliament

Auditors appointed by the Control Committee

PricewaterhouseCoopers Oy, Finland, Responsible Partner Jukka Paunonen, Authorised Public Accountant (KHT)

Öhrlings PricewaterhouseCoopers AB, Sweden, Responsible Partner Peter Sott, Authorised Public Accountant

Secretary to the Control Committee

Christina Stenvall, General Counsel, NDF

Board materials

Nordic Council of Ministers

The Nordic Council of Ministers (i.e. the five Ministers of Nordic Cooperation) is the body responsible for, among other things, amendments to NDF’s Statutes and capital. The Nordic Council of Ministers also approves the annual report of the Board of Directors and the audited financial statements of NDF.

Capital

NDF’s capital base is provided from the development cooperation budgets of the five Nordic countries. Each member country has subscribed to a certain portion of the capital, calculated according the scheme of allocation for joint Nordic financing between the Nordic countries. The scheme of allocation reflects each Nordic country’s proportion of the Nordic Region’s total gross domestic income at factor cost for the last two calendar years.

The capital of NDF has been increased as follows:

1989 SDR* 100 million

1993 SDR 150 million

1996 SDR 265 million

2000 EUR 330 million

2020 EUR 350 million

100% of the capital committed between 1989 and 2000 has been paid in over time, and the same will apply to the capital committed in 2020.

The total amount of NDF’s capital and the respective portions of the member countries are set out in the Statutes.

The available liquidity to fund NDF’s operations is the result of paid-in capital, inflows from the portfolio of financed projects and return from treasury operations.

According to NDF’s Liquidity and Investment Management Policy, NDF’s liquid assets should at the beginning of every calendar year cover all its payment obligations for at least twelve months ahead including an additional 20% buffer for unexpected disbursements.

NDF’s accounts are kept in EUR and consequently the financial statements are presented in EUR.

* Special Drawing Rights (SDR) are supplementary foreign exchange reserve assets defined and maintained by the International Monetary Fund (IMF). The value of an SDR is based on a basket of key international currencies reviewed by IMF every five years.

Managing Director

The Managing Director is appointed by the Board of Directors for a term of up to five years at a time. The Managing Director is responsible for the ordinary operations of NDF, which also contains responsibility for operationalising and otherwise implementing Board decisions. The Managing Director is assisted and advised in the work by the Executive Management Committee and the Risk Committee.

Executive Management Committee and Risk Committee

The Executive Management Committee (EMC) is a body established to assist and advise the Managing Director in all aspects of performance, policy, operational activities and financial sustainability of NDF. EMC is NDF’s highest-ranking internal committee. The Managing Director chairs the EMC. NDF has a Risk Management Policy which forms the core of and defines NDF's Risks Management Framework. As part of this framework, the Risk Committee (RC) is a body established to monitor its overall management and, in particular, to assess and make recommendations in specific risk events. The role of the RC is to support the Managing Director in making decisions related to risks and opportunities, ensuring all key risks are captured and appropriately managed.

Staff and location

NDF employs around 30 people, all working at the headquarters in Helsinki, Finland. The NDF headquarters is in the same building complex as the Nordic Investment Bank (NIB) and the Nordic Environment Finance Corporation (NEFCO).